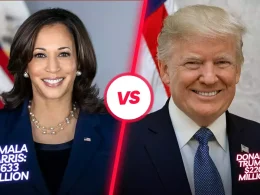

Global Alarm: Corporates and Nations Brace for the Impact of a Possible Trump Second Term

As the world watches Donald Trump’s bid for a return to the White House in 2024, businesses and governments alike are grappling with the implications of his potential second term. The Trump presidency from 2017 to 2021 left an indelible mark on the global order, characterized by protectionist policies, diplomatic unpredictability, and economic disruption. A renewed Trump administration promises a continuation—and potentially an escalation—of these trends, stoking fears in boardrooms and government halls worldwide.

The Global Legacy of Trump’s First Term

Trump’s first term was marked by a sharp break from traditional U.S. leadership in global affairs. The “America First” agenda prioritized domestic economic interests, often at the expense of international cooperation. Key policies, such as withdrawing from the Paris Climate Agreement, imposing tariffs on allies and rivals alike, and renegotiating trade agreements, sent ripples across the global economy.

While some countries and corporations benefited from Trump’s focus on deregulation and bilateral deals, others faced significant challenges, from disrupted supply chains to strained diplomatic ties. The unpredictable nature of his decision-making left little room for long-term planning, prompting a collective anxiety that now resurfaces as Trump positions himself for a political comeback.

Corporate Concerns: Navigating Volatility in a Trump 2.0 Era

1. Renewed Trade Wars and Supply Chain Disruption

Trump’s aggressive trade policies during his first term, particularly the U.S.-China trade war, imposed tariffs on billions of dollars’ worth of goods. These measures disrupted global supply chains and created economic uncertainty. Corporations worry that a second term could see even harsher trade restrictions, potentially targeting not just China but also other major economies like the European Union and India.

The specter of protectionism looms large, with businesses bracing for higher costs, retaliatory measures from trading partners, and delays in the global flow of goods. Companies that rely heavily on international trade, from tech giants to automobile manufacturers, are especially vulnerable to the fallout of renewed trade wars.

2. Unilateral Withdrawal from Multilateral Agreements

Trump’s disdain for multilateralism was evident in his withdrawal from the Trans-Pacific Partnership (TPP) and the Paris Climate Agreement. Businesses and governments fear that a second Trump administration could lead to further erosion of global institutions, such as the World Trade Organization (WTO) or NATO.

For corporations, the lack of stable international frameworks complicates market access and regulatory compliance. For nations, it raises concerns about geopolitical stability and the ability to address transnational issues like climate change, cybersecurity, and pandemics.

3. Tax Reforms and Economic Nationalism

While Trump’s first-term corporate tax cuts were welcomed by many, they contributed to ballooning federal deficits. A second term might bring drastic tax overhauls, potentially including tariffs disguised as border taxes or new levies on foreign income. Such moves could pit multinational corporations against nationalist economic policies, forcing them to rethink their global strategies.

Smaller economies reliant on U.S. trade and investment, particularly in Latin America, Southeast Asia, and Africa, fear being sidelined in favor of domestic U.S. interests, exacerbating economic inequality between nations.

4. Big Tech and Data Sovereignty

Trump’s antagonism toward Big Tech during his first term raises alarms in Silicon Valley and beyond. His criticism of companies like Amazon, Facebook (now Meta), and Twitter, coupled with potential antitrust actions, could disrupt the global tech ecosystem.

Additionally, Trump’s approach to cybersecurity and data privacy could lead to regulatory fragmentation, with countries and corporations facing conflicting demands over data sovereignty, cross-border data flows, and artificial intelligence governance.

5. Immigration Policies and Talent Shortages

Corporations and countries reliant on immigrant talent are bracing for stricter immigration policies under a second Trump term. From H-1B visa restrictions to travel bans, the previous administration’s stance on immigration created challenges for industries dependent on foreign expertise, such as technology, healthcare, and education.

Countries like Canada and Germany, which have benefited from attracting skilled workers turned away by U.S. policies, could see renewed competition—or further opportunities if Trump doubles down on his restrictive stance.

Geopolitical Repercussions: A World on Edge

1. Strained Alliances and Shifting Power Dynamics

Allied nations worry about the potential unraveling of U.S. commitments to collective security under NATO and other international agreements. Trump’s criticisms of NATO’s funding mechanisms and his overtures to autocratic leaders like Vladimir Putin and Kim Jong-un raised questions about U.S. reliability as a global leader.

This uncertainty could embolden rivals like China and Russia to assert themselves more aggressively, forcing U.S. allies to bolster their defense capabilities and reconsider their strategic alliances.

2. Economic Fragmentation and Regional Blocs

Trump’s preference for bilateral trade deals over multilateral agreements could accelerate economic fragmentation. Countries might respond by strengthening regional trade blocs, such as the European Union, ASEAN, or the African Continental Free Trade Area (AfCFTA), to counterbalance U.S. unilateralism.

This shift could create new opportunities for corporations agile enough to navigate regional markets but risks marginalizing U.S.-centric businesses in the global economy.

3. Climate Policy Rollbacks

Trump’s skepticism of climate science and rollback of environmental regulations during his first term drew criticism from global leaders and climate-conscious corporations. A second term could derail international climate initiatives, such as the COP agreements, and hinder progress toward achieving global net-zero targets.

Countries heavily invested in renewable energy and green technologies may face setbacks if Trump undermines the U.S.’s role in global climate finance and cooperation.

Corporate and National Strategies: Preparing for the Unknown

To mitigate potential risks, corporations and governments are adopting proactive strategies:

- Diversification of Supply Chains: Companies are reducing reliance on single-country supply chains, particularly in China, to minimize exposure to trade disruptions.

- Investment in Regional Markets: Nations and businesses are strengthening ties within regional blocs to reduce dependency on U.S. markets.

- Lobbying and Advocacy: Corporations are ramping up lobbying efforts in Washington to influence potential Trump policies and safeguard their interests.

- Climate Commitments: Many multinational companies are doubling down on sustainability initiatives, anticipating consumer demand for greener products, regardless of federal policies.

- Geopolitical Realignment: Countries are exploring alternative alliances and partnerships to hedge against U.S. unpredictability, such as closer ties with the European Union or China.

The Global Stake in Stability

The world economy thrives on predictability and cooperation—two elements that Trump’s leadership style often disrupted. While his policies resonated with segments of the U.S. electorate, they left both corporations and countries grappling with uncertainty.

A potential second term for Trump would force the global community to once again adapt to a shifting landscape of economic nationalism, geopolitical brinkmanship, and domestic-focused policies. As the 2024 election approaches, the stakes for both corporate and national leaders could not be higher, with the future of global trade, diplomacy, and climate action hanging in the balance.