LG energy solutions is a baby company spinoff from LG chemicals three years ago with a strong footprint presence globally.

LG energy solution has a market share of 14%, and it supplies batteries 13 0f the top 20 global automotive brands.

For a few years, the world has been adopting fast towards the EV to save gasoline bills and the environment. World governments are encouraging EV cars by giving incentives.

The data from Statista market insights tells that EV vehicles have more demand, and LG energy solutions had best technology and proven company to capture the upcoming booming from EV automobile companies.

It produces lithium batteries for automotive, IT batteries, and ES batteries. They are also supplying batteries for drones, NASA space suits, and hybrid ships.

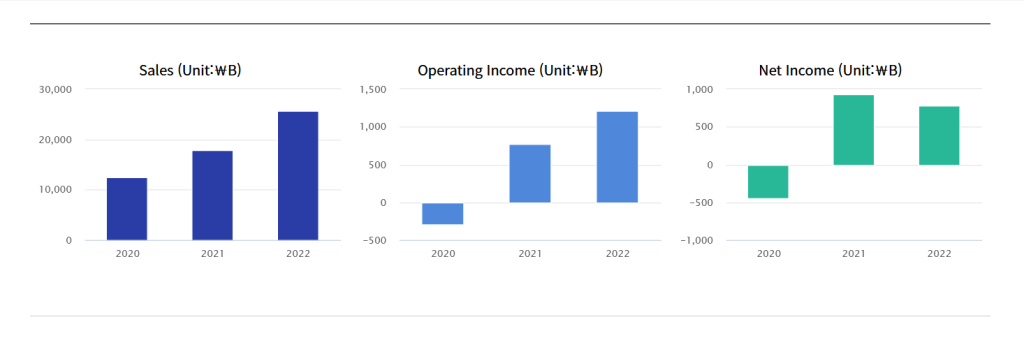

Financials

Its net sales in 2020 increased from 17,852 B ₩ to 25,599 B ₩ in 2002. The sales have advanced 35.65% year on year.

Its net profit from a loss of -449 B ₩ in the initial year of 2020 to a net profit of 780 B ₩ 2022

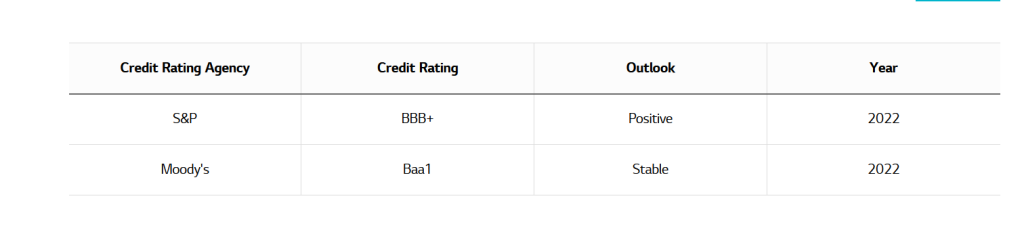

Ratings

The credit agency S&P had given a credit rating of BBB+, having a positive outlook, and Moody’s had assigned Baa1, having a stable outlook.

The business outlooks and finical details resemble the robust management of LG energy solutions, and right now, it is the second largest market capitalization in the Korean exchange. If we forecast future revenue and business growth it shares price is worth more than 1,000,000 KRW

International geopolitical tensions

The Russia and Ukraine war implementing sanctions on the crude export of Russia to control funding to battle created a skyrocket in crude oil prices. This leads world countries to shift to adopting EV automobiles more faster to control spike of energy bills, leading to the great advantage of LG energy solutions to increase their sales volumes. The G8 countries and the quad countries are wretched by China’s domination in the world. Up to now, the US has imposed extreme sanctions on technology companies to generate revenue and keep dominance worldwide by supporting its economic superpower. However, in the future, the technology superpower also be lithium batteries, so China battery technology companies may come under sanctions. We can see LG energy solutions’ biggest wealth creator soon.

Method of focus points used for the approach to writing report

Management Leadership style

Innovations in business

Financial data

Economic factors

Forecasting based on some parameters.

If anyone likes my research report, I am interested in writing more, but the company I should focus on must at least be worth researching.

Disclaimer

I am a certified research analyst from NISM, approved by SEBI.