ASML’s Future Share Price: A Comprehensive Analysis of the Semiconductor Giant’s Growth Potential

ASML Holding N.V. (ASML) is a cornerstone of the semiconductor industry, a critical player that powers the production of advanced chips necessary for emerging technologies such as artificial intelligence (AI), 5G, and autonomous vehicles. The company’s innovative technologies, particularly its dominance in extreme ultraviolet (EUV) lithography systems, make it a key driver of progress in the global tech ecosystem.

For investors, ASML’s future share price trajectory is a topic of keen interest. This article provides a detailed analysis of the factors that could influence ASML’s stock performance in the coming years, offering insights into its growth potential, industry challenges, and evolving market dynamics.

ASML’s Current Market Position and Financial Health

Dominance in the Semiconductor Supply Chain

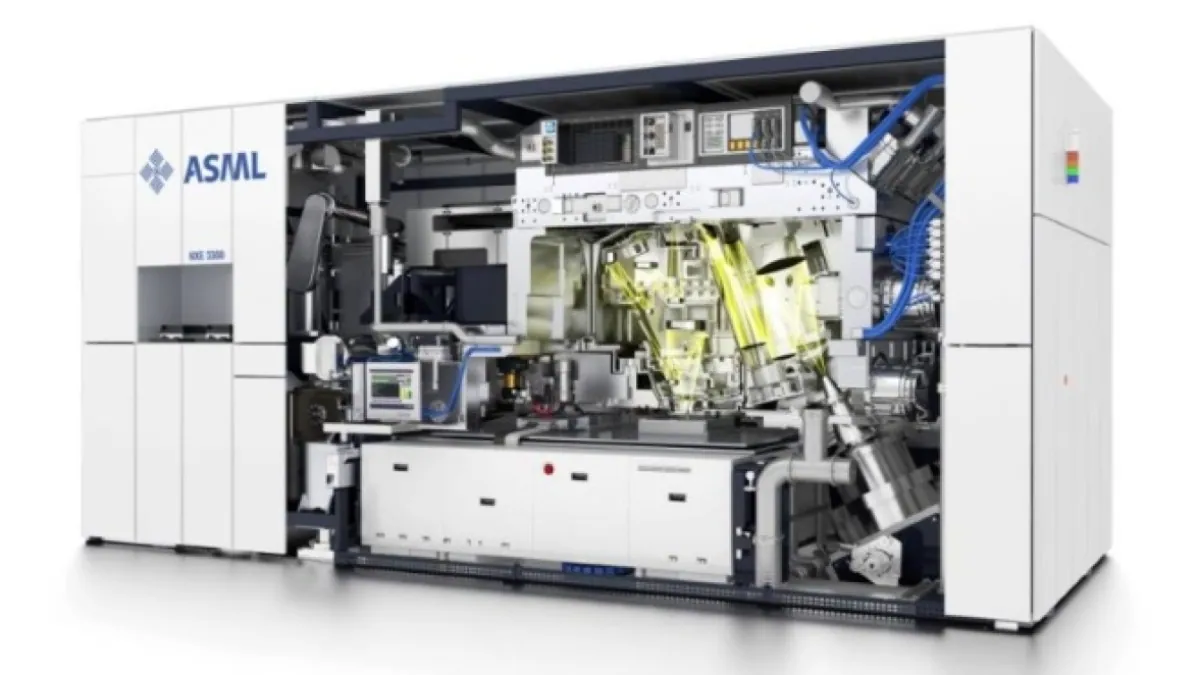

ASML is the exclusive supplier of EUV lithography machines, a technology essential for manufacturing cutting-edge chips. These chips are used by major semiconductor companies such as Taiwan Semiconductor Manufacturing Company (TSMC), Samsung, and Intel. Given its monopoly in this segment, ASML enjoys a powerful pricing advantage and steady demand, cementing its position as a market leader.

Recent Share Price Performance

As of 2024, ASML’s stock trades in the range of $600–$700 per share, with a market capitalization exceeding $250 billion. Over the last decade, its share price has shown consistent growth, reflecting robust financial performance and a strong order book. The company has benefited from surging demand for advanced semiconductors used in high-growth sectors.

Key Drivers of ASML’s Future Share Price

1. Increasing Demand for Semiconductors

The global semiconductor market is projected to grow significantly, driven by advancements in AI, Internet of Things (IoT), 5G, and electric vehicles (EVs). With chips becoming smaller and more complex, demand for ASML’s EUV systems, which enable such advancements, is expected to remain strong.

2. Expansion in Advanced Chip Manufacturing

Leading chipmakers like TSMC and Samsung are aggressively expanding their capacity to meet global demand. These expansions often require ASML’s equipment, ensuring a steady stream of revenue. Additionally, new applications such as AI training and inference chips rely on cutting-edge semiconductor technologies, further boosting demand.

3. Monopolistic Position in EUV Technology

ASML’s unrivaled position in EUV lithography gives it a competitive edge. Its systems, priced at around $150 million each, are indispensable for producing advanced nodes. With no immediate competitors in the EUV space, ASML is well-positioned to maintain its technological lead.

4. Growth in DUV Technology

While EUV garners significant attention, ASML’s deep ultraviolet (DUV) machines continue to be in demand for less advanced nodes used in a wide range of consumer electronics. The complementary growth of DUV and EUV segments enhances ASML’s revenue diversification.

Challenges and Risks

1. Geopolitical Tensions

ASML operates in a geopolitically sensitive industry. Trade tensions between the U.S. and China, export restrictions, and supply chain vulnerabilities could impact its business. For instance, restrictions on selling advanced EUV machines to China could limit ASML’s growth potential in one of the largest semiconductor markets.

2. Dependency on Few Customers

A significant portion of ASML’s revenue comes from a handful of large customers, including TSMC, Samsung, and Intel. Any reduction in capital expenditure by these companies could adversely affect ASML’s financial performance.

3. High Valuation Concerns

ASML’s premium valuation, driven by its monopolistic position and growth potential, also makes it vulnerable to market corrections. Any slowdown in the semiconductor industry could lead to a decline in investor sentiment, impacting its share price.

Market Predictions for ASML’s Share Price

Short-Term Outlook (2024–2025)

In the short term, ASML’s share price is likely to experience moderate growth, supported by strong demand for both EUV and DUV systems. Analysts predict that continued investment in semiconductor manufacturing and ASML’s ability to fulfill its extensive order backlog will drive revenue growth. Market sentiment remains positive, with price targets ranging from $750 to $800 per share.

Medium-Term Outlook (2025–2030)

Over the medium term, ASML’s share price could see significant appreciation as demand for advanced semiconductors accelerates. The adoption of AI, quantum computing, and other cutting-edge technologies will require chips manufactured using ASML’s equipment. Analysts forecast a potential share price range of $1,000–$1,200 by 2030, assuming continued industry expansion and geopolitical stability.

Long-Term Outlook (Beyond 2030)

In the long run, ASML’s growth will depend on its ability to maintain technological leadership and innovate beyond EUV lithography. The development of next-generation technologies, such as high-numerical aperture (high-NA) EUV systems, could open new revenue streams. If successful, ASML’s share price could surpass $1,500 by 2035, solidifying its position as one of the most valuable tech companies globally.

Conclusion

ASML’s future share price is intrinsically tied to the growth of the semiconductor industry, its monopolistic position in EUV lithography, and its ability to navigate challenges such as geopolitical risks and market fluctuations. With a strong technological moat and robust demand for its products, ASML is poised for sustained growth in the coming decades.

For investors seeking exposure to the semiconductor sector, ASML represents a high-quality, long-term investment opportunity. While short-term volatility may arise, the company’s fundamentals and strategic importance to the global tech ecosystem make it a compelling choice for those with a long-term outlook.