In a major move and a jolt to Chinese EVs, European Union (EU) member states voted to approve new tariffs on China-made electric vehicles (EVs), marking the bloc’s largest trade dispute with Beijing in over a decade. The decision, announced on Friday, came despite opposition from the EU’s largest economy, Germany, revealing deep divisions within the bloc over how to address Chinese trade practices.

The tariffs, which could be as high as 45%, are set to take effect next month and remain in place for five years. These duties are aimed at countering what the European Commission views as unfair Chinese subsidies following a year-long anti-subsidy investigation. If implemented, the tariffs would significantly increase the cost of importing China-made EVs into the EU, potentially costing automakers billions and reshaping the competitive landscape in the European car market.

The measure has sparked contrasting reactions across the bloc, reflecting differing national priorities. While countries like France, Italy, and Poland strongly supported the tariffs, Germany—home to major automakers like Volkswagen, BMW, and Mercedes-Benz—was one of five nations that voted against the proposal. In total, 10 EU members voted in favor, five opposed, and 12 abstained. The proposal required opposition from a qualified majority of 15 EU member states, representing 65% of the population, to be blocked.

Economic and Political Fallout

The vote however, shows the growing tensions between EU member states regarding their commercial ties with China. Many countries have grown wary of China’s state subsidies, which have allowed Chinese companies to dominate certain markets, including the photovoltaic sector, where China controls over 90% of the EU market. This history has fueled support for tariffs, with some members determined not to repeat the perceived failures of the past, such as the EU’s inability to effectively curb Chinese solar panel imports.

Other countries, however, fear the repercussions of escalating trade tensions. German carmakers, for example, are concerned that tariffs will push Chinese companies to increase their production capacity within the EU, intensifying competition on European soil. Oliver Zipse, CEO of BMW, described the vote as “a fatal signal for the European automotive industry.” Meanwhile, Geely Holding, a major Chinese automaker, expressed “deep disappointment” with the Commission’s decision. Hungary’s Prime Minister, Viktor Orbán, even warned that the EU was heading towards an “economic cold war” with China.

Shares in European carmakers like Renault and Volkswagen, however, rose after the vote, with investors hopeful that the tariffs would help European manufacturers compete against their Chinese rivals as global demand slows. France’s PFA car association welcomed the decision, supporting free trade but emphasizing that it must be fair.

China’s Response

Unsurprisingly, China reacted strongly to the EU’s decision. Beijing had already launched its own investigations into imports of EU brandy, dairy, and pork products earlier this year, raising fears of a tit-for-tat trade war. French cognac producers, in particular, expressed their frustration, accusing French authorities of abandoning their sector in the face of Chinese retaliation.

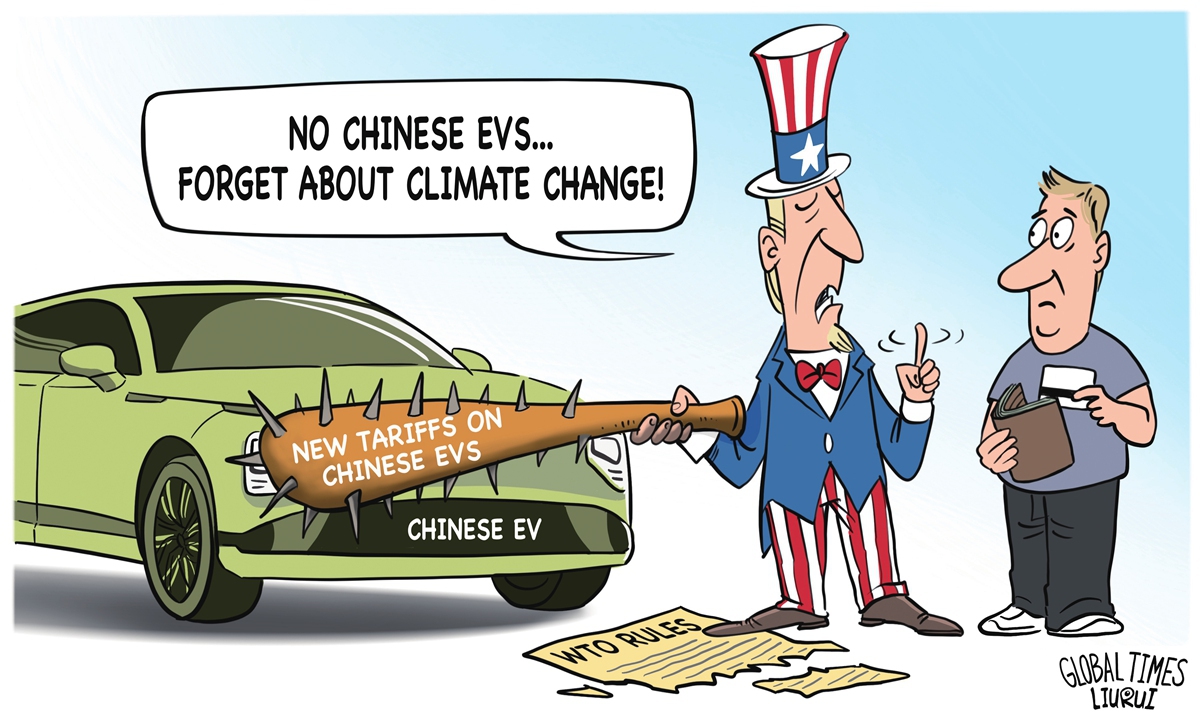

Although China’s Commerce Ministry condemned the proposed EU tariffs as “unfair” and a violation of World Trade Organization (WTO) rules, it stopped short of announcing concrete countermeasures. China has, however, launched a WTO challenge against the tariffs. One potential Chinese response that could hit Germany particularly hard is a proposal to raise import duties on large-engined gasoline vehicles.

These trade tensions could have broader economic implications. Higher tariffs on China-made EVs could raise prices for European consumers, potentially undermining the EU’s ambitious goal of becoming carbon neutral by 2050. Some analysts warn that the move might delay the shift to electric vehicles, which is already under pressure from the EU’s 2025 CO2 reduction targets. Campaign group Transport & Environment cautioned that delaying these targets would stagnate EV production in the EU, limiting the availability of affordable models.

The EU’s Hardening Stance on China

The EU’s approach to China has become noticeably tougher in recent years. While Beijing is still seen as a necessary partner in certain areas, it is also increasingly regarded as both a competitor and a systemic rival. With the U.S. and Canada imposing 100% tariffs on Chinese EVs, Europe has become the primary export destination for Chinese manufacturers, and the Commission is determined to protect its domestic market.

The Commission noted that China’s spare production capacity of three million EVs annually is double the size of the entire EU market, raising concerns about a flood of cheap imports. In response, the EU is exploring options to mitigate the impact of these tariffs while still addressing China’s trade practices. One possibility is a price undertaking, which would set minimum prices for Chinese EV imports to avoid undercutting EU manufacturers.

The effectiveness of the tariffs remains to be seen. Although the new duties are higher than those imposed on Chinese solar panels a decade ago, some industry experts are skeptical about their ability to protect the European car market. Laurent Ruessmann, a partner at RB Legal who defended the EU industry during the solar panel dispute, questioned whether the measures would be enough to safeguard European automakers, saying, “It’s better than solar panels, but is it enough to save an industry? I would be surprised.”

What It Means for Chinese EVs

The EU’s newly imposed tariffs on Chinese electric vehicles (EVs) are set to have significant ramifications for China’s EV industry, particularly its export growth to Europe. The sanctions could lead to reduced market share, increased prices for Chinese EVs in the EU, and possibly ignite retaliatory trade measures from China, escalating tensions between the two economic powerhouses. However, some Chinese manufacturers may respond strategically by investing in European production facilities to bypass the tariffs.

Key Points on the Impact on China

Reduced Market Access:

The primary effect of the EU’s tariffs will be a decrease in Chinese EV exports to Europe, as the added costs may diminish their competitiveness. This could result in a substantial loss of market share in a crucial export market for Chinese automakers.

Price Increases:

To absorb the cost of the tariffs, Chinese EV manufacturers might be forced to raise prices for their vehicles in the EU. This could affect the affordability and appeal of Chinese EVs in the European market, reducing their competitive edge.

Investment Shifts:

To circumvent the tariffs, some Chinese companies could opt to build production facilities within Europe. This would allow them to produce EVs locally and avoid the import duties, helping to maintain their presence in the European market.

Escalating Trade Tensions:

The EU sanctions may provoke retaliatory actions from China, such as higher tariffs on European products, sparking a potential trade war. This could have broader economic repercussions, affecting industries beyond the automotive sector.

Impact on China’s Economic Growth:

The EV sector is a critical component of China’s broader economic growth strategy. Disruptions to EV exports could, therefore, have a ripple effect on China’s overall economic performance, potentially slowing down growth in a key industry.

Factors to Consider:

Severity of Tariffs:

The extent of the impact on Chinese EV exports will depend on the level of tariffs imposed by the EU. Higher tariffs could have a more profound impact on export volumes and profitability.

The Great Divide, EU vs. U.S. on Chinese EVs

While the EU’s decision to impose tariffs on Chinese EVs signals growing alignment with the United States in terms of economic policies towards China, there are important differences in their approaches that indicate the need for transatlantic coordination on managing China’s economic practices.

The Division Bell, Washington And Brussels

The United States and the EU have taken divergent paths in dealing with Chinese EVs. The U.S., having had minimal exposure to Chinese battery electric vehicle (BEV) imports, took preemptive action by imposing sweeping tariffs on Chinese goods. In May, the Biden administration increased tariffs on Chinese BEVs from 25% to 100%, citing unfair government subsidies that posed a threat to the U.S. auto industry and American jobs. Canada soon followed, raising tariffs on Chinese BEVs to 100% as well.

In contrast, the EU’s approach has been slower and more complicated. European Commission President Ursula von der Leyen launched an official investigation into Chinese EV subsidies, emphasizing that market distortions by China were stifling EU leadership in the EV sector. However, the need for approval by member states made the process more protracted, revealing divisions within the bloc. Countries like France and Italy supported stronger tariffs to combat market imbalances, while Germany, whose automotive sector is heavily reliant on Chinese markets, led opposition to the move.

Despite this split, the EU’s eventual decision to impose tariffs does not necessarily signal a complete withdrawal from engagement with China. While some EU nations, such as France, are pushing for a harder stance on Chinese economic practices, they also remain interested in fostering cooperation with China in certain areas, including BEVs.

China’s Campaign to Divide the EU Fails

In the lead-up to the pivotal October 4 vote on tariffs, China launched a concerted campaign aimed at dividing the European Union (EU) on this critical issue. Beijing intensified its diplomatic efforts after the EU set provisional tariff rates in July, slightly adjusting them in August following a public comment period. China’s strategy included high-level outreach by President Xi Jinping, alongside negotiations led by key figures such as Minister of Commerce Wang Wentao and Minister of Foreign Affairs Wang Yi.

Wang Wentao’s negotiations with the EU, combined with efforts by German Chancellor Olaf Scholz, initially showed some progress, with the postponement of the final vote from September 25 to October 4. This delay followed Wang Wentao’s meeting with European Commission Executive Vice-President Valdis Dombrovskis on September 19, which offered China one last opportunity to propose a deal compelling enough to either mitigate the tariffs or end the investigation altogether.

Although the vote eventually moved forward as planned, the European Commission has signaled that negotiations with China can continue, even after the tariffs take effect later this month. This leaves room for a potential diplomatic resolution, despite the imposition of the tariffs.

China’s Retaliatory Threats

One of the more public tactics Beijing employed was the threat of retaliatory trade measures aimed at specific EU member states, focusing on key export sectors like pork, brandy, and dairy.

France, a significant exporter of all three products, emerged as a primary target for China’s retaliation, as Beijing viewed it as the chief advocate of the EU’s tariff policy. Spain, another major pork exporter, altered its stance after Spanish Prime Minister Pedro Sánchez met with Xi Jinping in Beijing on September 9. Spain ultimately abstained from the vote on October 4, a significant shift from its earlier nonbinding support for the tariffs on July 15. However, other pork exporters, such as the Netherlands and Denmark, maintained their support for the tariffs.

Ireland, a leading dairy exporter to China, also stuck with its decision to abstain, consistent with its informal vote in July. Ten other EU nations remained undecided, reflecting the complexity of the issue and varying domestic priorities. Four countries—Slovakia, Hungary, Cyprus, and Malta—voted against the tariffs, while Germany, under intense domestic pressure, shifted from an abstention in July to an outright “no” vote on October 4, after Chancellor Scholz exerted executive authority.

Carrots and Investment Opportunities But….

In addition to its threats, China also dangled potential investment opportunities to sway EU member states. Beijing proposed establishing electric vehicle (EV) manufacturing plants in parts of Europe and forging joint development agreements between European and Chinese automakers. For example, China offered to invest in Spain’s local manufacturing capabilities. Although delayed until October 2025, Chinese EV maker Chery Auto plans to build a manufacturing plant in Barcelona, potentially enabling the company to bypass the 21% tariff it currently faces.

Hungary, which voted against the tariffs, is set to have a BYD manufacturing plant operational by 2025. Italy, despite voting in favor of the tariffs, is in talks with Chinese automakers Dongfeng and Chery Auto about setting up a local manufacturing plant. Poland, another country that voted in favor of the tariffs, has helped China sidestep some of the restrictions by allowing the joint venture Leapmotor International—between Stellantis and Leapmotor—to begin production in the country as early as June 2024.

Perhaps most surprisingly, Polestar, owned by China’s Geely Holding and Geely-owned Volvo Cars, launched a manufacturing plant in South Carolina in August. This move could allow Polestar to avoid some of the tariffs imposed by both the United States and the EU, showcasing how Chinese companies are adapting to navigate trade restrictions.

So What’s In The Game….

The approval of tariffs on China-made electric vehicles marks a major turning point in EU-China trade relations. While the decision has strengthened the European Commission’s stance in negotiations with Beijing, it has also exposed deep rifts within the bloc, particularly with Germany.

Still, as both sides brace for potential retaliatory measures, the future of EU-China trade hangs in the balance, with significant implications for the global automotive industry and broader economic relations.

On the other hand, China’s multi-pronged campaign—ranging from diplomatic outreach to retaliatory threats and promises of investment—shows its determination to soften the EU’s stance on tariffs.

However, despite these efforts, the October 4 vote proceeded with the EU’s decision to impose the tariffs.

Still, China’s strategy has left the door open for further negotiations, and its ongoing offers of investment may continue to influence individual EU member states as the situation evolves whether through investment in local production or diplomatic maneuvering, Beijing’s response to these tariffs will be closely watched, as it could reshape trade relations between the EU and China for many years to come.