Tata Motors Group is a USD 42 billion leading global automobile manufacturing company. Its diverse portfolio includes cars, sports utility vehicles, trucks, buses, and defence vehicles. Tata Motors is one of India’s largest OEMs, offering a comprehensive range of integrated, innovative, and e-mobility solutions. In 1945, Tata Motors started manufacturing steam locomotives, later foraying into truck manufacturing, bringing global trucking technology to India in 1954.

Tata Motors was the first Indian company to introduce the fully indigenous Indian passenger car, Indica; It was designed and developed in India, which changed the overall business dynamics of the automobile industry in India. The Tata Motors group has presence in over 125 countries and R&D centers in the UK, Italy, India, and South Korea.

India’s car market became the third largest market in the world after overtaking Japan in terms of sales. Tata Motors has a firm grip and presence in India and the world. India’s car market is unique, and many big global players missed the pulse of Indian customers and eventually shut their operations and exist from the Indian market. Altroz, Tiago, Tigor, Punch, Nexon, Harrier, safari are the tata motor car brands. All Tata cars are rated in between 4 to 6 NCAP safety ratings, which always gives a better edge over its competitors and significantly impact the final decisions by customers in a particular category they would like to buy a car. Currently, in the SUV segment division, Tata Nexon is a market leader, and Punch is positioned simultaneously ranked at number 3 in the same segment.

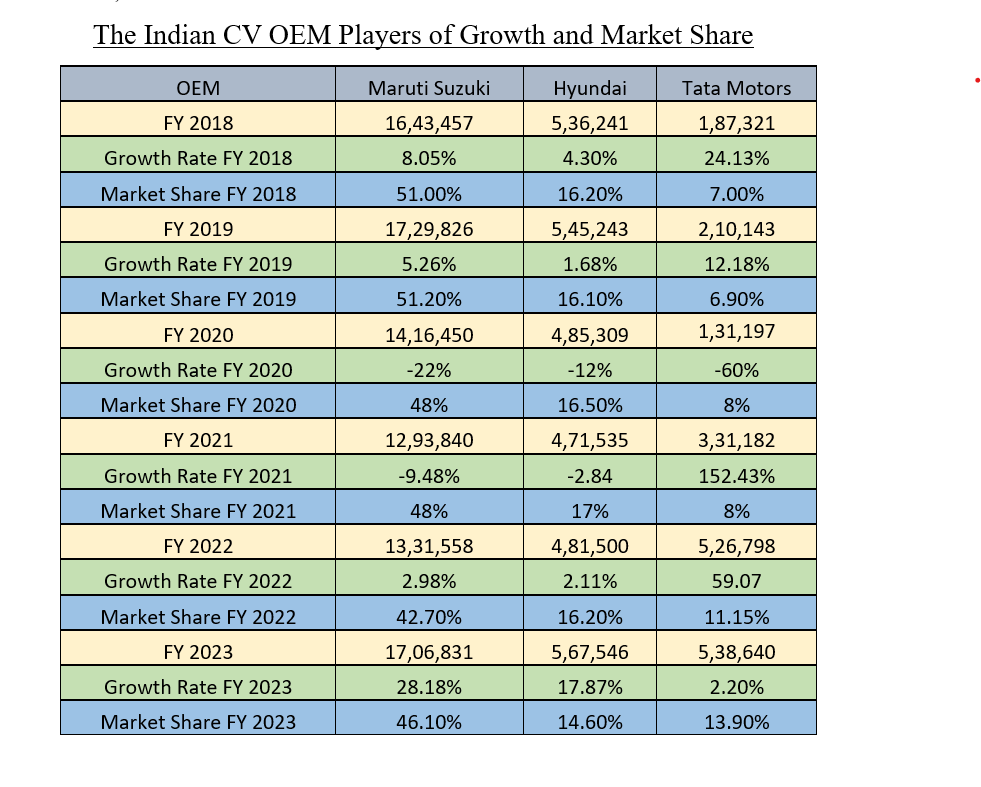

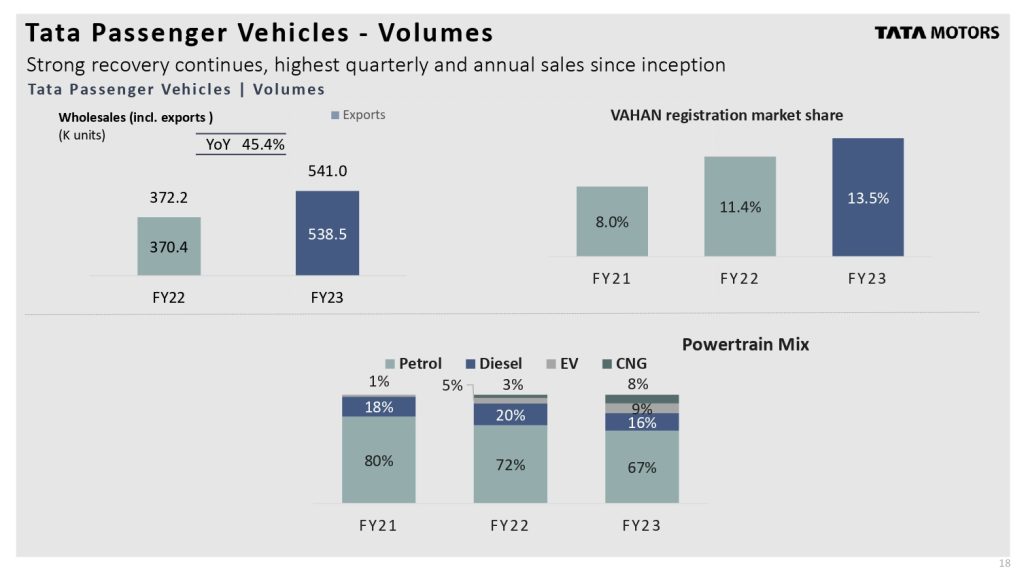

Before 2018, the tata motors were ranked in the 5th position. It slowly picked up the race and made a stranded position in number 3, and this year, in a few months, it beats Hunyadi in sales by few units of volume, giving the best competition and looking to conquer the number 2 position soon. The close integration of technology and design by both JLR and Tata Motors gives the best advantage to design better cars to meet customers’ needs and expectations and by saving costs. From FY 2018 to FY 2023, it is clocked at 187.55% sales growth in India. It is a healthy growth even though the industry had setbacks of Covid with very few sales and by the sudden move of government regulation by moving directly from BS4 to BS6. Supply chain distributions and semiconductor chip shortage. The close integration of Tata Motors with JLR gave a new boost. We can see the recent facelift of every passenger car and performance in Tata Motors all models. Its market share increased from 7.0% in FY 2018 to 13% in FY 2023.

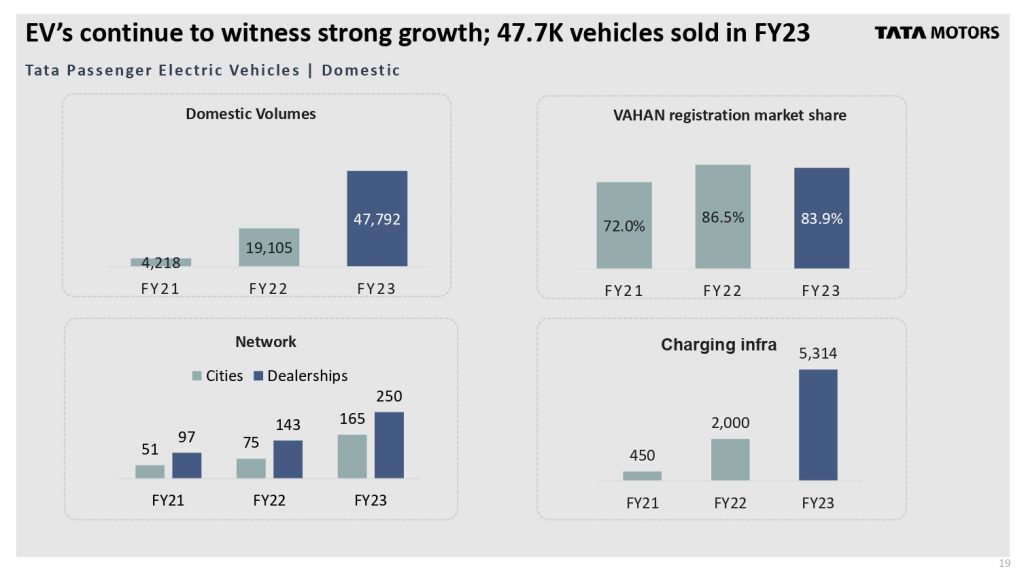

Tata Motors entered into EV Passenger cars market in 2018, and now it is a top leader in India and has a market share of 85%. Tata Motors is launching a new EV car model from all its traditional engine car portfolio models. It is performing Consecutively in 3 years of market-beating growth. The PV business turned profitable in FY 23 and has Crossed the landmark of 5 million vehicle sales since its inception. It started EV car infrastructure in India and laid a clear road map for the future for all OEMs. We all know the Indian government has laid a clear road map; by 2030, every new car sold in India should be electric. Tata is a market leader in EVs, having the best technology and infrastructure. In the near future, it can overtake market leader Maruti because it still doesn’t have a single best EV model. So, most automobile car manufacturers will eventually lose the market share by the dominance of more EV car models with the best technology and infrastructure provided by Tata Motors. Recently, they acquired a plant of Ford motors in Sanad, which tells their orders are in full swing.

JLR

Jaguar and Land Rover is one of the most robust luxury brands in the world. JLR is declared highest ever sales and contributing overall profit share to the parent company Tata Motors

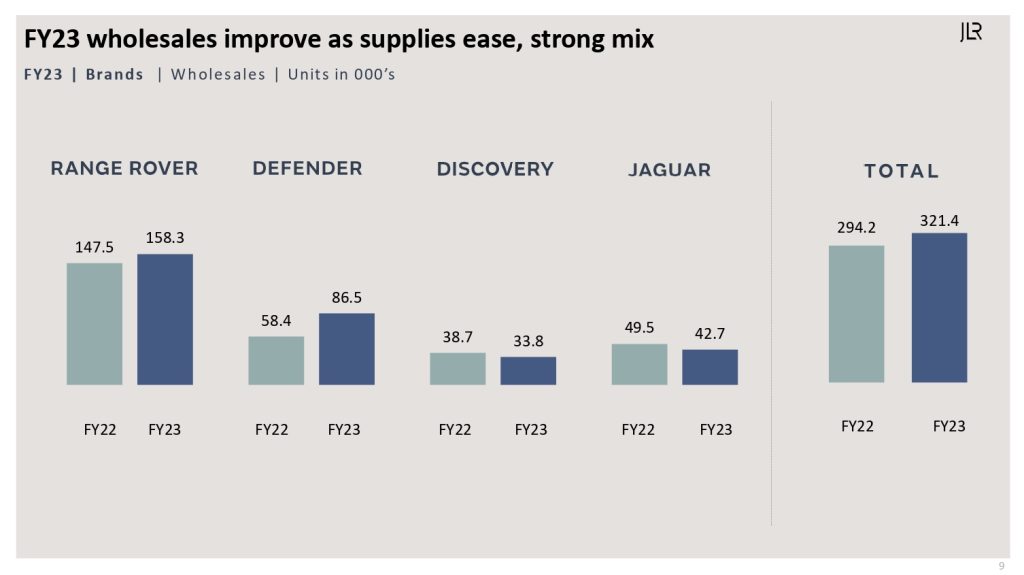

In JLR, Range Rover and Defender are pulling the entire company’s burden. Jaguar is ultimately shifting its division to EV. So, it is in a transforming stage, ready to rock the market, but still, the overall JLR is performing exceptionally well.

Recently, Tata Motors invested 42,500 crores of INR in the UK to build a 40-GW cell gigafactory unit. This unit will be used to develop electric mobility and renewable energy storage solutions for UK and European customers. This investment tells the future ambition plan for JLR to produce EV cars in high volumes. It brings more extra revenue and technical integration with Tata Motors.

Tata Motors Commercial Vehicles

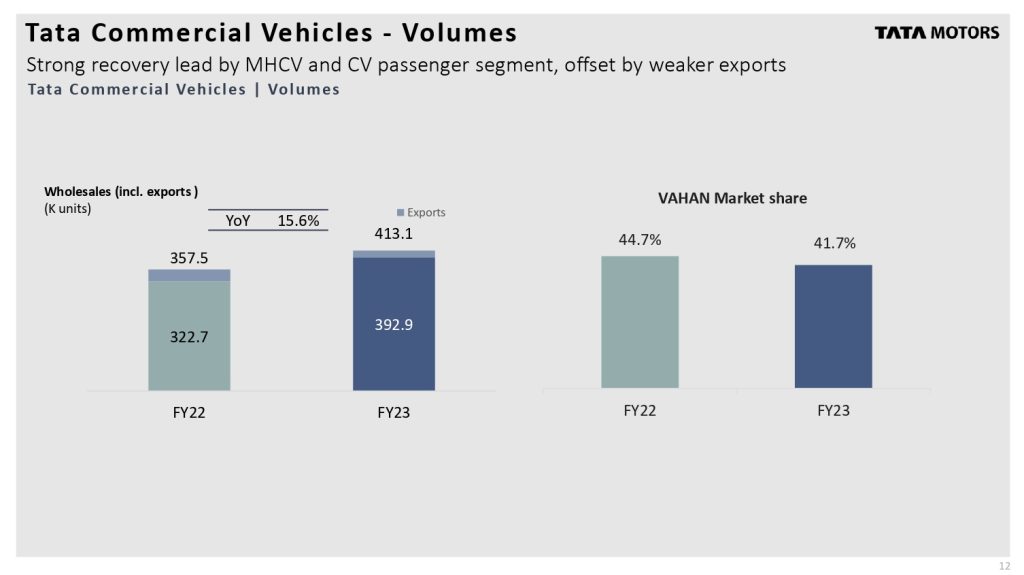

Tata Motors is the market leader in the segment of commercial vehicles and has a dominant market share of 47.5%. The Indian commercial vehicle has been in a cyclic stage for a few years. After the automobile industry in India was transformed from BS4 to BS6 by skipping the middle number. The on-road vehicle cost is increased because of the new technology and upgraded vehicle parts, and the burden of purchasing an extra AdBlue liquid fuel was mandated after B6 integration in commercial vehicles. We can see a substantial number of domestic and export sale volumes will increase soon because the economy is growing rapidly, so the movement of goods will pick up quickly and create the need for transportation. The sales of new commercial vehicles will pick up soon. The Tata Motors has Signed definitive agreement for operating 1,500 buses in Delhi, 921 buses in Bengaluru, and 200 buses in Jammu & Kashmir. TML e-bus fleet cumulatively crossed 70 million Kms with >95% uptime in FY23. Tata Motors has launched its EV division for LCV, and they had tied up with Big Basket, Flipkart, and Amazon.

Financials

The financial results for FY-23 have beat the market street expectations, and Tata Motors declared the highest-ever revenue of INR 346.0k crores with the highest EBITA since FY-2015 of INR 37.0k crores. Its net debt is the lowest in 15 years with INR 6.2k Crores. It declared a best dividend of 2 rupees per equity share with 100% face value and 2.1 per share for DVR holders. This healthy financial result reflects the strong footprint of sales from different segments and increased revenue generation, capturing more bite of market share than ever before. The company’s net debt was reduced to INR ₹43,600 crores from INR ₹48,700 crore at the beginning of FY23, which will decrease the burden on the company. The Management commitment to be net debt zero by the next financial year is a massive boost to the company operations, and it will create a good impression on the investors’ confidence to hold shares for the long run. These financial results tell us they are performing best and on an excellent sustainable growth track.

Revenue Segment

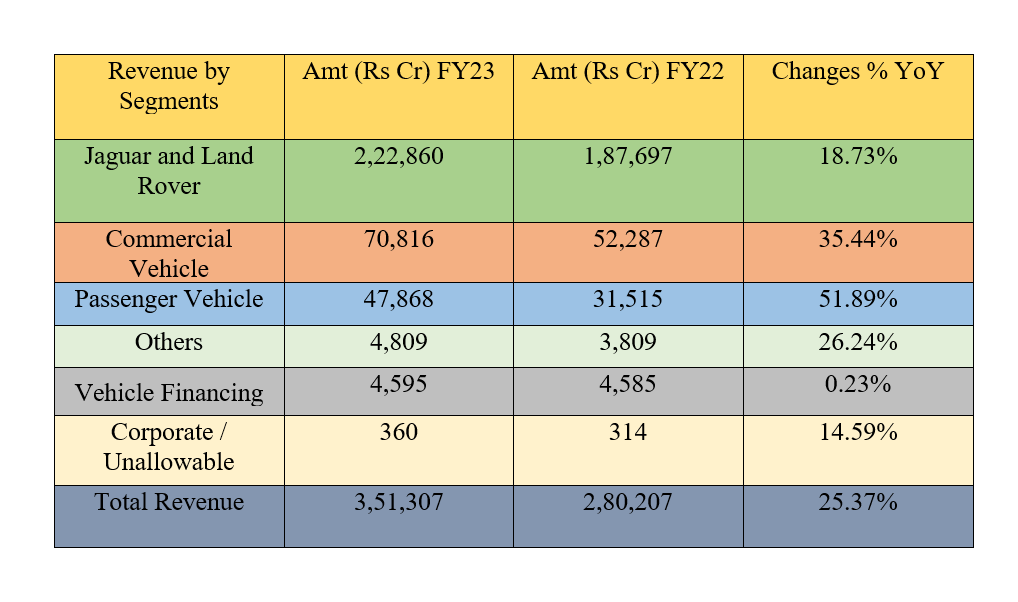

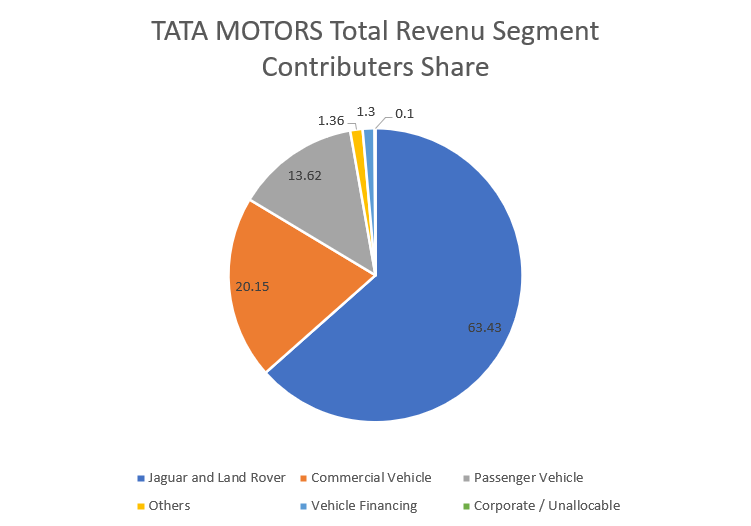

In the tata motors revenue segment, the passenger vehicle segment has given highest growth of 51.89% while we compare with FY22 even though commercial vehicle segment has many obstacles on the way and still we see a massive growth of 35% when we compare with FY22 in next coming years it will deliver the highest volumes in domestic sales and exports. The JLR segment is always a heavy contributor in revenue to the group and it has given growth of 18.73% when compared with FY22. The total JLR is in transformation stage so in the upcoming financial years we can see the huge revenue generation and the contribution to the group. The overall total revenue is INR 3,51,307 crores in FY23 and in FY22 it was INR 2,80,207 crores with a growth rate of 25.37%.

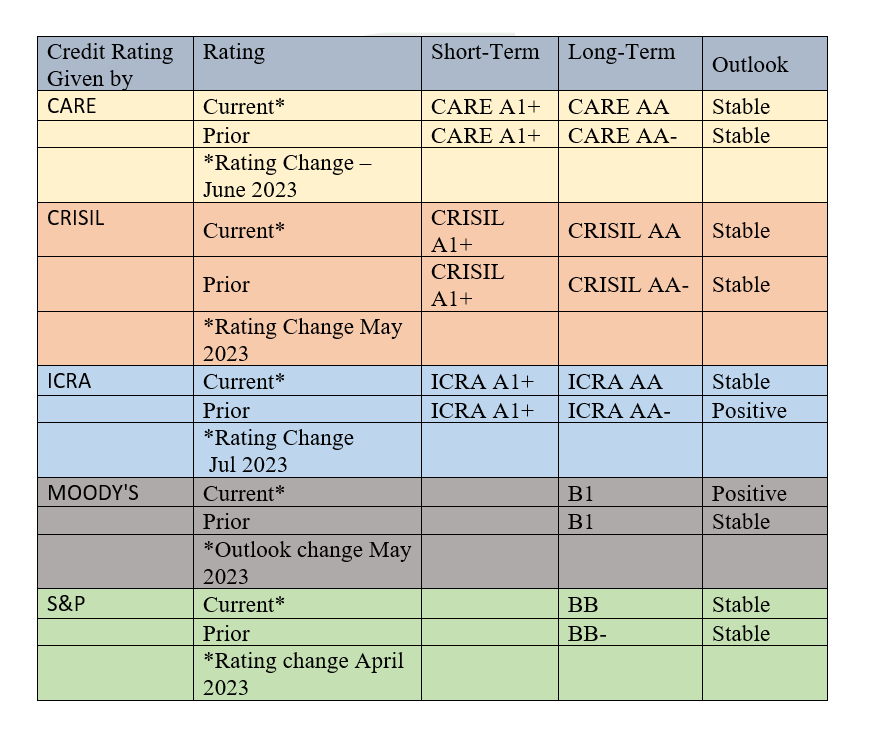

Credit Rating

The CARE, CRISIL, and ICRA have updated their rating from AA- to AA with a stable outlook. The MOODYS maintain the same rating of B1 but they had been updated with a positive outlook. The S&P upgraded its rating from BB- to BB and gave a stable outlook.

These positive credit ratings tell us that the company is going on smooth, sustainable growth, with a solid business of continuous, more regular revenue generation in future years. So, it will be very safe for the financials who seek safe and healthy returns on investments in Tata Motors. In the future, Tata Motors can get credit loans with an easy process and the best reasonable interest rates. It can raise capital by using bonds with a premium. A Good credit rating helps the shareholders to gain more trust in the company to hold for the long term.

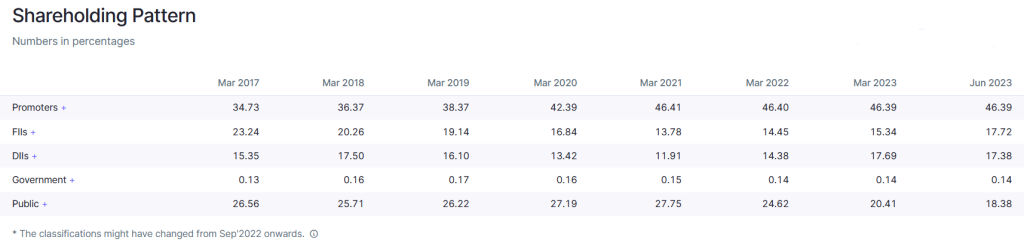

Shareholding Ratios

The promoters in the company have increased their stake from 34.73% in the year 2017 to 46.39% in the current 2023 year, which tells the straightforward visionary story of promotors towards a Tata Motors that will have a great future and can perform better when compared to the past and because of that promoters are continuously increasing their stake by buying shares. The promoters feel that the current share value is trading below the fair value, and soon, it would be worth more than that in near future.

FIIs and DIIs keep increasing their stake in the company slowly; they are always one of the best-mind people in the market; they do a lot of research and can predict a company’s future outcome. If the stake of FII and DII keeps increasing, a company’s business will have good future revenue and steady growth in the long run. Finally, this would be the hot chick to buy for retail investors, which would be worth more return on future if we had invested at present.

Management

The Tata Group is known for its values and ethics by always believing in sustainable growth. The chairman, Chandrasekaran, is a great visionary leader; he can turn any organization into a profit and has a proven track record of transforming a small organization of TCS into India’s top and one of the world’s best IT company. He closely integrated Tata Motors and JLR, which saved a lot of expenditure by bringing breakthrough models, designs, new facelifts, and performance, making Tata Motors top 3 places in passenger vehicles in India. In 2018, by his visionary future Tata Motors entered the EV market, gaining a dominant market share of 80%, and this year, the new venture turned into a profit. He brings confidence, trust, energy, innovation, and strategies to the overall stakeholders of a company. With his strong vision and leadership, Tata Motors will reach more heights soon.

Industry

The Indian automobile industry, within five years, will become the world’s largest automobile market. China is the market leader at present and the USA is in second position. The Indian automobile industry is 7.5 lakh INR crores, contributing 7.1% to the GDP by adding 49% to the manufacturing GDP. The world automobile industry generates a revenue of 2.86 trillion US$ with a growth rate of 4.5%. The Indian government, in a new road map for 2030, says every car sold in India should be an EV and EV have a growth rate of 49% by creating five crores of direct and indirect jobs. The automobile industry is transforming from burring traditional fossil fuels to environmentally friendly EVs. However, this industry is still in an incubating stage and needs more funds, R&D infrastructure, and cooperation between all the stakeholders in the industry.

Economy

According to the World Bank, the Indian GDP is 6.9%. The automobile industry has already overcome from the shocks like COVID lockdown, logistic supply chain distributions, and semiconductor shortages. Finally, implementing BS6 by skipping BS5 created a burdened for the sector to meet government safety standards and strict regulations. It is stranded at present. So, Indian automobiles will grow together with India and its economy. Everyone has been saying that a recession will come soon since 2020; everybody knows that the automobile industry will be affected first if a recession hits the world. However, I don’t see a recession soon because the world is transformed into a more centralized digital economy. We survived with ease even from the COVID lockdown logistic supply chain distributions, the world’s largest trader shut its economic doors, the Ukraine and Russia war created commodity shortage crises, the collapse of SVB and Credit Suisse, global big MNCs announced a layoff to control unnecessary costs in order to survive in the upcoming tough times, The Europe biggest economy went to recession and China facing a deflation in the economy. Even with all these happening, only few companies and some parts of the world economy are affected. Now the modern digital economy behaves very differently from the past lessons of great depression, dot-com bubble, and 2008 US housing crisis. This is more centralized digital economy; we cannot find any breakages to procure raw material by transforming into a finished good until the good is finally being consumed; we can see a lot of disturbances in the middle of the process. But ultimately the good is still finding its true owner. By now, most companies and industries have entered and returned from the recession. So, the economy of the world and India is outstanding, which will add extra fuel to the growth story of Tata Motors.

Why Tata Motors is still trading under a FAIR VALUE

- SUV is the largest segment and has a rapid growth in passenger vehicles. Nexon is a top leader in this segment, and Punch occupies the third spot. The passenger car sales growth is best, and eventually, they are eating the market share of top players.

- In The EV segment Tata Motors is a market leader with 80% and turns into profitable venture. By 2030, every car should be electric. The market leaders are not having the best in EV single model up to now at least. In the future, their traditional car sales and revenue will be occupied by Tata Motors.

- JLR is still performing best and giving massive revenue to the group, but once the transformation stage is finished, they will generate more sales and revenue when compared with present growth rate.

- In the commercial vehicles they are performing best. the cyclic stage of transformation is finishing soon. The Indian economy is growing, and FDI investments are increasing. We can see the massive traffic within the country’s interior; the country would need more commercial vehicles in future days.

- The commitment of management towards a net debt zero by FY24.

- The recent FY23 results has beaten market expectation by giving a best ever highest revenue generating figures in the history of company but still the share price has been trading at the same level from when the company has declared final results at company AGM this year.

- Considering some of the above reasons, I firmly believe that Tata Motors is trading far below the fair value of the actual share.

Method of focus points used for an approach to write a report

Management

Leadership style

Innovations in business

Financial data

Economic factors

Forecasting is based on some other parameters.

If anyone likes my research report, I am interested in writing more, but the company I should focus on must at least be worth researching.

Disclaimer

I am a certified research analyst from NISM, approved by SEBI.