Jio Begins Work on ₹40,000 Crore IPO: A Major Step for India’s Telecom Giant

In one of the most anticipated developments in the Indian financial markets, Reliance Jio, the telecommunications arm of Mukesh Ambani’s conglomerate Reliance Industries Limited (RIL), has begun preparations for an Initial Public Offering (IPO) that could raise a staggering ₹40,000 crore. This is set to be a game-changing move, marking a pivotal moment in India’s telecom sector. The IPO is expected to be one of the largest ever seen in the country and could have far-reaching consequences for not only Jio but the broader telecom and financial markets in India.

The Rise of Reliance Jio

Reliance Jio made its market debut in 2016 and quickly became a disruptive force in India’s highly competitive telecommunications market. The company’s entry into the sector was nothing short of revolutionary, as it introduced affordable, high-speed 4G services to millions of Indians who had been traditionally underserved by more expensive providers. The telecom landscape was forever changed with Jio’s introduction of free voice calls, extremely low-cost data plans, and widespread 4G coverage.

This aggressive pricing strategy created a massive wave of subscriber growth, which saw Jio’s user base soar rapidly, reaching over 479 million subscribers in just a few years. The company’s ability to offer a world-class digital experience at an affordable price has allowed it to dominate the telecom space, making it the largest telecom operator in India, surpassing older incumbents like Bharti Airtel and Vodafone Idea.

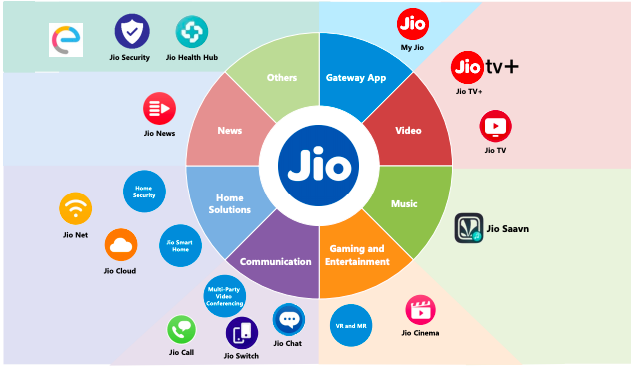

In addition to its telecom services, Jio has expanded into multiple other areas, including fiber broadband, JioMart (an e-commerce platform), and JioTV. The company has built an extensive ecosystem that ties in with its parent company’s business interests, allowing for synergies that few competitors can match.

However, despite its dominance, Reliance Jio has remained a privately held entity, with its shares owned entirely by the Ambani family and a small group of investors. Now, as the company prepares for its long-awaited IPO, Reliance Jio seeks to tap into the enormous capital markets and make its stock publicly available to investors across India and beyond.

The ₹40,000 Crore IPO: What to Expect

Reliance Jio’s upcoming IPO is expected to raise between ₹35,000 crore to ₹40,000 crore (approximately $5 billion to $5.5 billion), making it one of the largest IPOs in India’s history. If successful, this would not only provide Jio with the capital it needs to further expand its digital offerings and infrastructure but would also open up one of the country’s most lucrative tech businesses to public investors.

The IPO is likely to be structured in such a way that a portion of the offering will consist of fresh capital, while another portion will involve the sale of existing shares by current investors. This type of dual offering allows Jio to raise significant funds for expansion while also providing early backers, such as private equity firms, an exit route.

One of the key elements that will draw investors to the IPO is Jio’s track record of rapid growth. Over the past few years, the company has consistently grown its subscriber base, with Jio expected to cross 500 million users in the next year. Furthermore, Jio has significantly increased its ARPU (Average Revenue Per User), which has been a critical factor in its path toward profitability.

Reliance Jio has also made large investments in digital infrastructure, including a state-of-the-art fiber broadband network that is expected to drive future growth. The company has also heavily invested in a wide range of digital services, including cloud computing, e-commerce, entertainment, and fintech, all of which present enormous growth potential.

The Market’s Expectations: Why This IPO Matters

For investors, the Jio IPO presents a rare opportunity to invest in one of India’s most promising and fastest-growing tech companies. There are several reasons why Jio’s IPO has attracted so much attention:

- Market Leadership: Jio’s market leadership in the Indian telecom sector provides investors with a level of confidence. As the largest telecom operator, Jio benefits from the economies of scale and brand recognition that smaller players struggle to match. The company has proven its ability to capture market share through aggressive pricing and the delivery of innovative services.

- Digital Services Expansion: The growth of digital services like broadband, e-commerce, and digital payments is one of the key drivers of Jio’s future growth. Jio has already made significant investments in these sectors, and it is well-positioned to benefit from the growth of India’s internet economy. As more Indians go online for shopping, entertainment, and financial services, Jio stands to gain from being deeply embedded in these segments.

- Strong Financials: Reliance Jio’s financial performance has been impressive, especially given the large investments it has made in infrastructure. The company is expected to become more profitable in the coming years as its massive subscriber base and growing ARPU contribute to its earnings.

- Reliance’s Backing: The backing of Reliance Industries, one of India’s largest conglomerates, adds a layer of credibility and security for investors. With Mukesh Ambani at the helm, Jio has access to resources and capital that most telecom companies in India can only dream of.

- The Digital Transformation of India: India is undergoing a digital transformation, with internet penetration rising rapidly across the country. As more rural and urban consumers gain access to smartphones and affordable data, Jio stands to be a central player in this shift, making it an attractive investment opportunity.

:strip_icc():format(webp)/kly-media-production/medias/4761612/original/076863800_1709559000-Snapinsta.app_428705427_18329640865187733_3500254863386639156_n_1080.jpg)

The Road Ahead: Potential Risks and Challenges

While the Jio IPO is expected to be a major success, there are a number of risks and challenges that could affect its performance:

- Intense Competition: While Jio has been the dominant player in the telecom sector, it faces strong competition from other telecom giants like Bharti Airtel and Vodafone Idea. These companies are also investing heavily in 4G and 5G technology, which could potentially reduce Jio’s market share.

- Regulatory Hurdles: The telecom sector is heavily regulated in India, and any changes in government policy could impact Jio’s business. Additionally, there could be challenges related to spectrum allocation, pricing regulations, or other government policies that may affect Jio’s operations.

- Debt Levels: Despite its strong growth, Reliance Jio has taken on significant debt to fund its expansion plans. While the company has shown a clear path toward profitability, its debt load could potentially become a burden if growth slows down or interest rates rise significantly.

- Execution Risk: Expanding into new digital services is a complex and competitive endeavor. While Jio has made significant strides in areas like e-commerce, cloud computing, and digital payments, it still faces competition from established players like Amazon, Google, and Paytm. The ability to execute successfully in these areas will be crucial for Jio’s long-term success.

- Market Volatility: As with any large IPO, the performance of Jio’s stock will be affected by broader market conditions. Economic slowdowns, geopolitical tensions, or domestic political uncertainty could all impact investor sentiment and affect the IPO’s success.

Conclusion

Reliance Jio’s preparation for an IPO is a landmark event in India’s corporate landscape. If successful, the IPO will not only make Jio one of the largest publicly traded companies in India but also serve as a key milestone in the country’s digital transformation. The company’s dominance in the telecom market, combined with its aggressive push into digital services, positions it well for the future.

For investors, the Jio IPO represents a unique opportunity to gain exposure to one of India’s most dynamic and innovative companies. However, as with any investment, there are risks to consider, and investors must be mindful of the challenges the company may face as it navigates a rapidly changing telecom and digital services landscape.

As the Indian economy continues to evolve, Jio will likely play an even more significant role in shaping the future of digital services in the country. For now, all eyes are on the upcoming IPO, which promises to be one of the most exciting and high-profile market events in recent years.