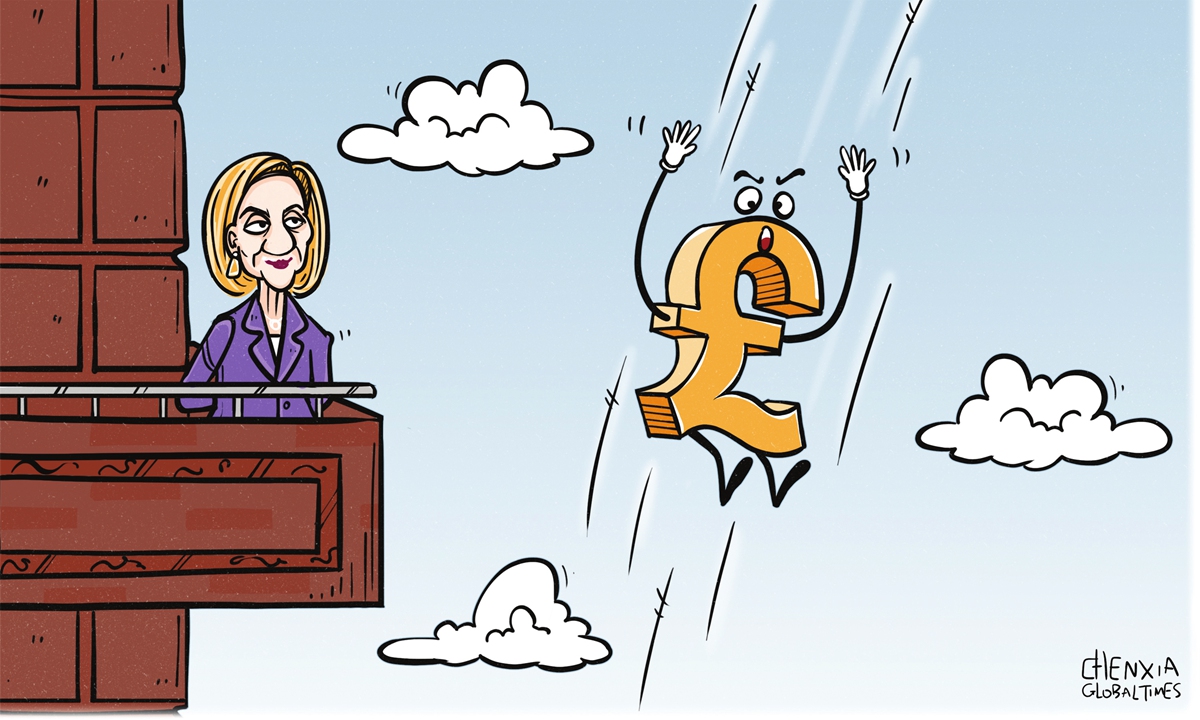

UK Economy Shrinks for Second Month: October GDP Contraction Sparks Recession Fears

The United Kingdom’s economic landscape is facing mounting pressures as recent data reveals a second consecutive month of contraction. In October, the UK’s Gross Domestic Product (GDP) shrank by 0.1%, amplifying concerns that the country may be sliding into a recession. This decline, coming on the heels of September’s economic slowdown, underscores the challenges faced by policymakers, businesses, and households alike as they navigate a volatile economic environment.

The Data Behind the Decline

The Office for National Statistics (ONS) reported the October GDP figures, which reflect a combination of contractions in various sectors. Services, manufacturing, and construction—three pillars of the UK economy—have all shown signs of weakness. The service sector, which accounts for approximately 80% of the UK’s GDP, experienced stagnation, while manufacturing output fell amid supply chain disruptions and rising input costs. Construction, often a bellwether for economic activity, also declined due to weakening demand in the housing market and delays in major infrastructure projects.

October’s contraction was modest but significant, signaling a continued downward trajectory. With September’s GDP also shrinking, the UK is now teetering on the brink of a technical recession, typically defined as two consecutive quarters of economic decline. This precarious position is compounded by external and domestic challenges that have stymied growth and eroded consumer and business confidence.

Causes of the Economic Slump

Several interrelated factors have contributed to the UK’s economic woes:

1. High Inflation

Inflation remains a critical challenge, with rates hovering at multi-decade highs. Although there have been slight decreases from peak levels, the cost of living crisis persists. Elevated prices for essentials such as energy, food, and housing have squeezed household budgets, curtailing consumer spending, which is a key driver of the economy.

2. Interest Rate Hikes

In an effort to tame inflation, the Bank of England has implemented a series of interest rate hikes. While these measures aim to stabilize prices, they have also increased borrowing costs for businesses and individuals. Mortgage rates have risen sharply, adding strain to the housing market and reducing disposable income for many homeowners.

3. Global Headwinds

The UK’s economy is not immune to global economic trends. The ongoing conflict in Ukraine has disrupted energy markets and exacerbated supply chain issues. Additionally, slowing growth in major trading partners, such as the Eurozone and China, has dampened export demand.

4. Post-Brexit Adjustments

The long-term economic impacts of Brexit continue to unfold. Trade barriers and regulatory divergence have created friction for businesses, particularly those reliant on exports to the European Union. Moreover, labor shortages in key sectors, exacerbated by post-Brexit immigration policies, have constrained productivity.

5. Energy Crisis

The energy crisis, triggered by geopolitical tensions and reduced gas supplies, has disproportionately affected the UK due to its reliance on imported energy. High energy costs have weighed heavily on industrial output and household budgets alike.

Implications for Businesses and Households

The economic downturn has far-reaching implications for both businesses and households. Companies across various industries are grappling with declining demand, rising costs, and tightening credit conditions. For small and medium-sized enterprises (SMEs), these pressures are particularly acute, as many lack the financial buffers to weather prolonged economic uncertainty.

Households, meanwhile, are contending with the twin challenges of high inflation and stagnant wage growth. The cost of living crisis has forced many families to make difficult choices, cutting back on discretionary spending and prioritizing essentials. This shift in consumer behavior has created ripple effects throughout the economy, with sectors such as retail and hospitality bearing the brunt.

Policy Responses and Challenges

The UK government and the Bank of England face a delicate balancing act in responding to the current economic challenges. Fiscal and monetary policies must be carefully calibrated to address immediate concerns without exacerbating long-term vulnerabilities.

1. Monetary Policy

The Bank of England’s interest rate hikes have been a cornerstone of its anti-inflation strategy. However, these measures carry the risk of deepening the economic slowdown. Striking the right balance between controlling inflation and supporting growth will be critical in the months ahead.

2. Fiscal Policy

The government’s fiscal strategy will play a crucial role in mitigating the impact of the downturn. Targeted support for vulnerable households, investments in infrastructure, and incentives for businesses could help stabilize the economy. However, high levels of public debt limit the scope for expansive fiscal measures, necessitating careful prioritization.

3. Energy Price Relief

Efforts to address the energy crisis are paramount. Policies to enhance energy security, such as diversifying energy sources and investing in renewables, could alleviate some of the pressures on households and businesses. Short-term measures, such as energy price caps and subsidies, may provide immediate relief but come at a fiscal cost.

4. Brexit-Related Adjustments

Policymakers must also address the structural challenges posed by Brexit. Reducing trade barriers, improving access to labor, and fostering closer collaboration with the EU could help mitigate some of the economic frictions.

Prospects for Recovery

While the outlook appears challenging, there are reasons for cautious optimism. The UK’s economy has demonstrated resilience in the past, and structural reforms could pave the way for a more sustainable recovery. Key areas of focus include:

1. Innovation and Technology

Investing in innovation and technology could boost productivity and drive long-term growth. Support for sectors such as fintech, green energy, and advanced manufacturing could position the UK as a leader in emerging industries.

2. Skills and Education

Addressing labor shortages and improving workforce skills will be essential. Enhanced training programs and initiatives to attract talent could help bridge gaps in critical sectors.

3. Infrastructure Development

Infrastructure investments, including transportation, digital connectivity, and housing, could stimulate economic activity and enhance competitiveness.

4. Global Trade Opportunities

Exploring new trade opportunities beyond Europe could help diversify the UK’s economic base. Strengthening ties with fast-growing markets in Asia, Africa, and the Americas could provide a valuable boost.

The Road Ahead

The contraction of the UK economy in October is a sobering reminder of the challenges facing the nation. While the risk of recession looms large, proactive measures by policymakers, businesses, and households could help mitigate the impact and lay the groundwork for recovery. The path forward will require resilience, adaptability, and a commitment to addressing both immediate and structural challenges.

As the UK navigates this critical juncture, the stakes are high. Decisions made in the coming months will shape the trajectory of the economy for years to come. With concerted efforts and strategic planning, there is hope that the UK can weather this storm and emerge stronger, more competitive, and better prepared for future challenges.